Wind-down planning is no longer a tick-box exercise – it is a supervisory priority. With increasing regulatory focus on how firms exit the market safely, particularly for entities within the payments and e-money sectors, getting your wind-down plan right has never been more important. The FCA’s June 2025 Multi-Firm Review of wind-down planning identified several critical areas needing improvement across the industry. These include inadequate financial modelling during the wind-down process and a lack of analysis on how issues such as safeguarding could extend the wind-down timeline.

At fscom, we’ve observed similar challenges among firms we support. One of the most persistent issues is estimating the true cost of executing a wind-down plan (WDP). In response, we conducted our own multi-firm benchmarking review, analysing cost data from a cross-section of payment institutions we work with. While our analysis focused on this sector, the insights are also relevant to e-money institutions and other regulated firms working to align with regulatory expectations.

Our approach: how we conducted the benchmarking exercise

We analysed wind-down plans from ten payment institutions in our client base. Our focus was on an accelerated liquidation scenario, i.e. a full wind-down where no buyer or transfer partner is found. This scenario is often the most operationally and financially demanding, yet many firms fail to prepare for it adequately.

To effectively review these plans, we have taken into account the FCA’s Finalised Guidance, thematic and multi-firm reviews to establish a baseline for good practice. Additionally, we have leveraged our own expertise in working with payment and e-money firms.

Our clients’ wind-down plans typically projected a nine-month period for accelerated liquidation. We evaluated the costs associated with maintaining core operations during this time and the additional one-off costs that arise only in a wind-down. These cost categories were then benchmarked against each firm’s normal operating costs to determine what proportion would realistically be required to support the wind-down process.

In line with the findings identified in the FCA’s Thematic Review in April 2022, we also examined how firms factored in extraordinary outflows, their assumptions on inflows (such as residual revenue), and how well they had documented and justified their assumptions.

What the FCA expects: financial and operational considerations

During the wind-down process a firm should have cash inflows and outflows, which are best monitored on a daily basis as follows.

- Inflows, (i.e. predicted revenue and other inflows that are likely to be limited after the triggering event and/or if a wind-down decision is made).

- Ordinary outflows, (i.e. the cost of maintaining operational premises and systems).

- Extraordinary outflows associated with winding down, such as extra closure costs, legal fees, professional services and insolvency practitioner fees, redundancy payments, retention payments, pension fund deficits, lease and other termination penalties and the costs of breaking contracts.

It recommends that firms consider if there is enough cash, or cash-equivalent investments, to meet this requirement during the full wind-down period.

There are also several guiding principles that are widely accepted within the industry.

- General staffing costs will reduce throughout the wind-down period.

- The costs associated with marketing and business development costs will significantly drop in the wind-down period.

- Long-term commitments during the wind-down period, such as office lease and costs associated with maintaining core FTE, continue throughout the period at much the same value.

WDPs must establish realistic timelines and conduct thorough assessments of how both financial and non-financial resources will be managed during the firm’s market exit.

Key findings: what the data tells us about wind-down costs

Wind-down timescales and assumptions

Before estimating costs, firms must determine the likely timescales needed for an orderly wind-down. Our review found that most firms underestimated this timeframe or failed to justify it. Like the FCA’s findings, we saw limited evidence of firms tailoring duration assumptions to their specific business models, contractual obligations, business model risks, or operational dependencies. The FCA noted an example concerning safeguarding, highlighting the absence of analysis for obligations such as the requirement to safeguard residual customer funds for six years.

In our data, firms generally used a nine-month period for a full liquidation, with four to six months assumed for a successful sale or transfer. However, even in the best-case scenario, several firms still had ongoing cost obligations, including non-cancellable contracts, extending beyond their assumed wind-down end date.

Breaking down the numbers: cost categories and breakdowns

We found it helpful to break wind-down costs into two core categories:

- Core minimum operating costs: These include rent, utilities, IT infrastructure, and salaries for retained staff. On average, these costs were about 16% of a firm’s usual operating expenses over the wind-down period.

- Wind-down-specific costs: These include redundancy payments, legal and professional service fees, and penalties for early termination of contracts. Together, they accounted for a further 5% of normal costs on average.

As shown in diagram 1, our analysis shows that the core minimum operating costs are 16% of the normal operating cost and there is estimated to be, on average, a further 5% of normal operational costs that is attributable to the additional expenses of winding down.

|

Accelerated liquidation – average cost as % of operating costs |

Total average |

|

WDP costs Core Operations Mode |

16% |

|

Additional costs due to wind-down (legal, external staff) |

5% |

|

Extra staff expenses |

2% |

|

Legal and other professional service fees |

2% |

|

Cancellation penalties with third-party providers |

1% |

|

Total |

21% |

Diagram 1: Accelerated liquidation – average cost as % of operating costs.

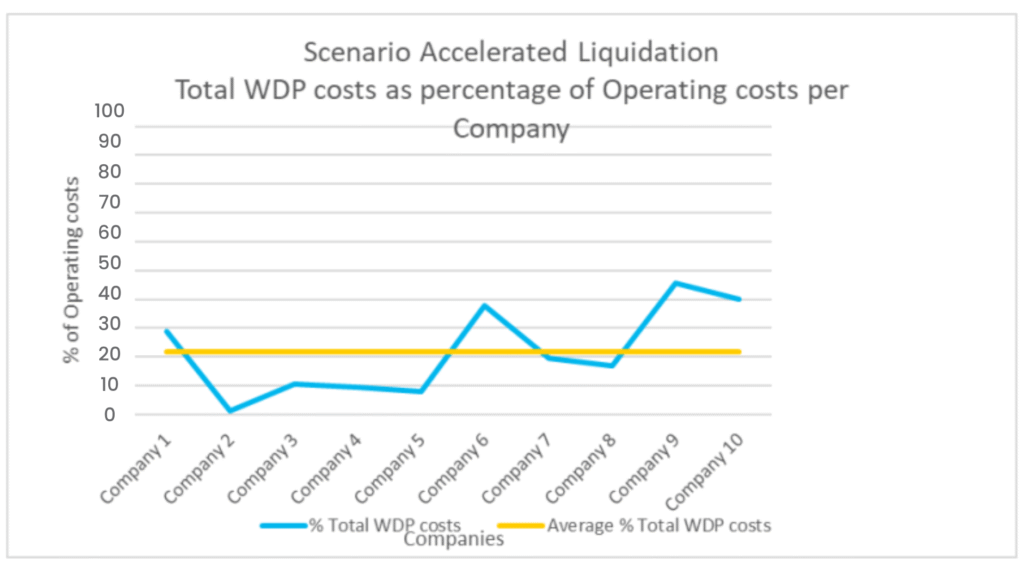

As seen in diagram 2, this brings the total wind-down cost estimate to 21% of standard operating costs. However, we also noted a significant variance across firms, with some projecting first month wind-down costs at 40–50% of their normal monthly spend, declining gradually over time.

Diagram 2: average WDP costs as a percentage of operating costs.

These findings support the FCA’s observation that while some firms attempted detailed cost breakdowns, others made vague or overly optimistic estimates without supporting data. It varied between firms, but generally the most established cashflow analysis resulted in daily cash flow forecasting for the first two weeks of the wind-down period, followed by weekly forecasts from week 2 to the end of month 3, and then monthly cash flows from the end of month 3 until the conclusion of the wind-down.

Moreover, we found that some firms failed to include critical extraordinary outflows identified in the FCA’s review, such as potential insolvency practitioner fees, penalties for contract termination, and retention payments. Others underestimated legal and regulatory engagement costs, particularly in cross-border contexts.

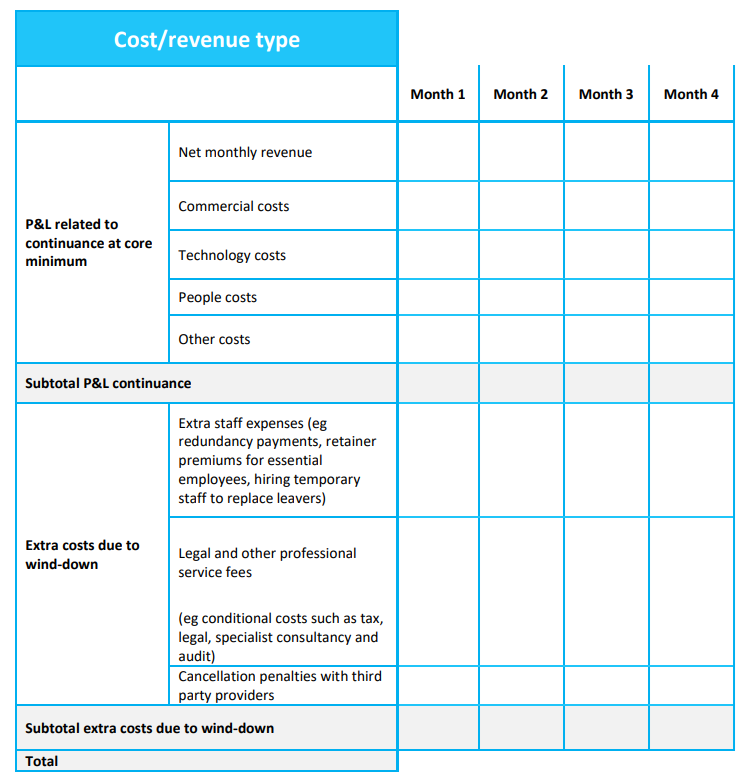

In diagram 3, the table provides an illustrative example of how these costs can be broken down, month-by-month, across the wind-down period, helping firms to visualise how expenditure may taper as operations are scaled back.

Diagram 3: Wind-down cost breakdown.

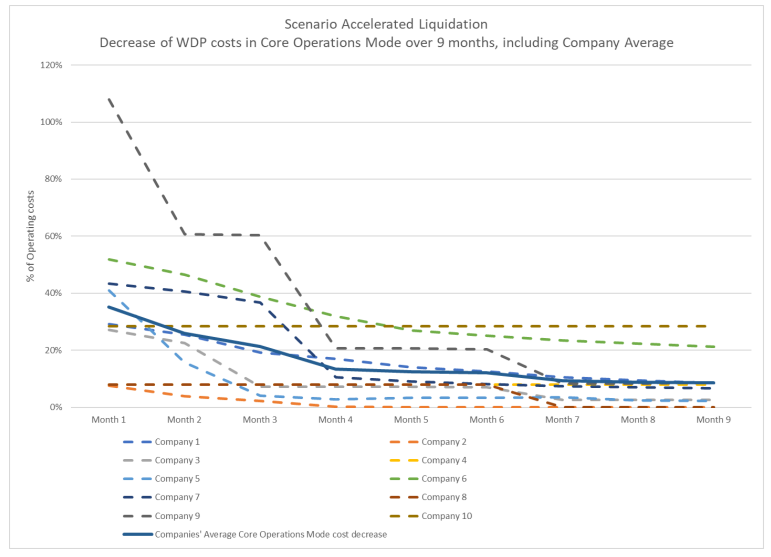

Illustrative example

As shown in the cost projections from our ten-firm review, illustrated in diagram 4, the overall cost burden decreases steadily over the wind-down period. This tapering effect reflects gradual reductions in staffing, infrastructure, and operational activity, a pattern also encouraged by the FCA, which recommends modelling costs week by week and month by month to justify how and when expenses will fall away.

Diagram 4: Scenario accelerated liquidation, total WDP costs as percentage of operating costs per company over time.

External risks and scenario testing

Our findings, consistent with those of the FCA, show that many firms did not adequately factor in broader economic, geopolitical, and market risks in their wind-down planning. While these factors are difficult to predict, they can materially impact the cost and feasibility of a wind-down. Due to insufficient scenario stress testing in many of the plans reviewed, it is difficult to assess how firms would address emerging risks, such as:

- Currency volatility impacting liabilities in non-GBP jurisdictions.

- Contract disruption from geopolitical conflicts or sanctions (e.g. in regions like Ukraine or the Middle East).

- Supply chain fragility, especially where third-party providers are concentrated or irreplaceable.

By incorporating such scenario testing, firms can better prepare for disruptions that could inflate wind-down costs or delay key milestones.

Practical takeaways: top tips for estimating wind-down costs

Based on our multi-firm review, ongoing client engagements, and insights from the FCA’s June 2025 review, we offer the following guidance:

- Understand your business model deeply: Tailor wind-down durations and costs to your specific legal, contractual, and operational landscape. Generic timelines will not meet regulatory expectations.

- Start with a realistic baseline: Many costs are fixed or slow to reduce. Our data shows that even in month one, some firms could only reduce operating costs to around 50% of normal levels.

- Include all extraordinary costs: Be sure to factor in legal and consultancy fees, redundancy packages, retention incentives, and termination penalties. These are often under-estimated, or omitted altogether.

- Engage your teams early: Your wind-down cost model should be informed by HR, legal, compliance, IT, and finance. The FCA highlighted a lack of cross-functional input in many of the plans it reviewed.

- Document everything: Clear rationale for assumptions, data sources, and benchmarks is essential. Without this, the FCA may challenge your cost credibility, as it did for multiple firms in the 2025 review.

- Keep your plan alive: Regularly review and update wind-down costs to reflect business growth, new obligations, and evolving risks. A static plan is unlikely to be compliant or fit for purpose when it’s most needed.

While this blog has focused primarily on costs, we note that wind-down plans must also account for potential revenue during the process. Although significantly reduced, some BAU activity may continue, and asset sales could contribute to inflows, both of which must be carefully modelled.

Need support with your wind-down plan?

At fscom, we go beyond cost benchmarking. We help firms build regulator ready wind-down plans. We help you define credible wind-down triggers, set appropriate financial thresholds, and map out every critical execution step, from customer fund reimbursement and dispute resolution to contract termination and regulatory communication. Our team provides independent expert assurance reviews to give you confidence that your plan meets the FCA’s expectations for credibility, clarity, and operational readiness.

Don’t wait for regulatory scrutiny, contact us today to strengthen your wind-down plan.

This blog contains a summary of regulatory guidance and is not a substitute for tailored legal or regulatory advice. Please consult your fscom adviser before acting on any of the above.