In this article, our subject matter expert discusses the impending deadline which will see cryptoasset firms brought within the UK financial promotions regime, what that practically means for qualifying firms and the steps they should take now to ensure they are ready by October.

On 8th June 2023, the Financial Conduct Authority (FCA) issued guidance and near final rules PS23/6 to extend the financial promotions regime to capture qualifying cryptoassets. PS23/6 presents a more focused and targeted approach to the regime for high-risk investments, introduced under the FCA’s PS22/10. PS23/6 is accompanied by guidance consultation (GC23/1). The final rules will be confirmed and expected to have effect from 8 October 2023.

Under the new regime, qualifying cryptoassets will be treated as a type of ‘Restricted Mass Market Investments’.

“Qualifying cryptoassets are any cryptographically secured digital representation of value or contractual rights that is transferable and fungible (including exchange tokens such as Bitcoin). This however, excludes instruments that already fall within the regulatory perimeter (e.g., securities, derivatives and units in collective investment schemes), electronic money, non-fungible tokens (NFTs) or cryptoassets that can be used only in a limited network.”

Through the implementation work that fscom has carried out to date, we have seen an increasing need for clarity regarding the rules banning incentives and the rules on appropriateness assessments. In this article, we provide further support in those areas, but flag that the FCA, will in due course, issue guidance which provides more detailed examples that set out the FCA’s expectations, along with how it applies to the cryptoasset market.

Applicability of the rules

The rules will apply to all firms that market qualifying cryptoassets to UK consumers, irrespective of the geographical location of the firm. It should be noted that the rules are technology agnostic and therefore, apply irrespective of the medium of communication (website, email, social media etc.).

From 8 October, firms will be permitted to market cryptoasset products where:

- The firm is an authorised person (regulated by the FCA).

- The firm is unauthorised but the promotion is approved by an authorised person (regulated by the FCA).

- The firm is registered with the FCA under the UK Money Laundering Regulations as a cryptoasset service provider. The exemption is limited to the provider communicating its own financial promotions.

- The firm’s promotion is exempt: The exemptions have been narrowed for cryptoasset promotions.

Authorised firms wishing to approve crypto promotions for unauthorised firms will have to apply to the FCA via the new financial promotions gateway before they start doing so.

Guiding principles – fair, clear and not misleading

All financial promotions must meet the regulatory standard of being fair, clear and not misleading. The fair, clear and not misleading rule applies in a way that is appropriate and proportionate taking into account the means of communication, the information the communication is intended to convey and the nature of the client and of its business, if any. In practice, firms should ensure that all marketing material are clearly identifiable as a financial promotion. It needs to be accurate, where factual information is given, it needs to be valid (up-to-date), it should be balanced, with the benefits and risks/exclusions given equal importance. It should be easy to understand by the average member of the audience to which the material is aimed.

To whom can qualifying cryptoassets be directly offered to?

The FCA provides that under the new regime, Direct Offer Financial Promotions can only be made to certain category of investors:

- Restricted Investor

- High-net worth Investor

- Certified Sophisticated Investor

A Direct Offer Financial Promotion (DOFP) is any promotion that includes a call to action for a customer to place an investment. This includes phrases like, “Invest now”, “Apply now”, “Click to Invest” and “Buy bitcoin here”, with a link direct to the page where the customer can place an order. Where marketing is communicated via brochure or other non-digital format, it should be noted that sending an application form is also a DOFP. It should be noted that self-certification is not permitted in relation to sophisticated investors.

Demonstrating compliance

Firms that will be subject to the new regime should start to review the end-to-end of their customers’ journey and to develop the appropriate policies, procedures, systems and controls to comply with the requirements. Compliance should not be the sole responsibility of the second-line. In order to ensure that the entire customer journey is given adequate attention, collaborative input from a variety of stakeholders will be required. This includes input from the marketing and sales desks, as well as technology teams.

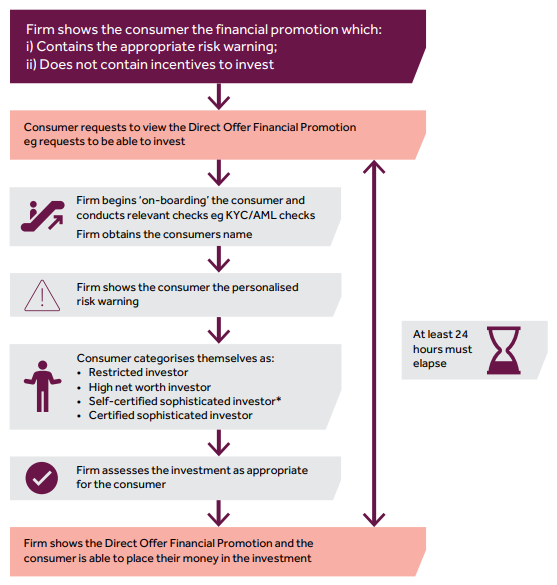

The FCA expects that before a customer places an order, in-scope firms should have completed the following steps:

- General and personalised risk warning

All cryptoasset promotions must contain a risk warning that must be prominently displayed.

Firms must also provide a personalised risk warning that directly addresses the prospective customer by name when they sign up for the first time.

There are form, content, timing, and prominence requirements, as well as requirements on how it must be provided. These include for example, the requirement for firms promoting crypto products to retail investors to include the following warning: “Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more.”

- Ban on incentives

The FCA places a ban on incentives that seek to persuade prospective clients to invest in cryptoassets, such as refer-a-friend promotions, new joiner bonuses, offering free cryptoasset or other time-limited offers. The rationale for this is to allow consumers to make effective investment decisions without being pressured, misled or inappropriately incentivised to invest in products that do not meet their needs. The ban applies regardless of the rationale for offering the incentive, which consumer the incentive is aimed at, or whether it might be incentivising related actions to investing, such as registration or sign up.

The FCA clarified that benefits that are intrinsic to the cryptoasset or exclusively bound up with its function and/or business model will not be considered an ‘incentive’. This might include features or benefits that are part of the terms and conditions associated with a particular cryptoasset. For example, cryptoassets that serve to provide the owner with voting rights, and which are used for the purpose of establishing governance arrangements for a particular platform or project would not be considered an incentive.

It is worth noting that lower fees that are available to all retail clients and not linked to the volume of trades made do not constitute a monetary incentive.

However, benefits that are not intrinsic to the cryptoasset, or exclusively bound up with its function or business model, and which are used to motivate a consumer to buy that cryptoasset are likely to be considered an incentive. The FCA adds that offering additional ‘free’ cryptoassets is likely to be considered an incentive. Furthermore, a feature or benefit is likely to be considered an incentive where it is only available for a limited time period.

- Client categorisation

Under the new regime, direct offer financial promotions can only be made to certain category of investors:

- High net worth investors (income of £100,000 or assets of £250,000 excluding primary residence and pension).

- Sophisticated investors (an authorised firm must deem an investor ‘sophisticated’)

- Restricted retail investors (those who agree to only invest up to 10% of net assets in high-risk investments).

The customer must sign a declaration stating they meet the relevant criteria.

- 24 hour cooling off period

Firms must give new customers a 24 hour cooling off period before they can invest with the firms for the first time. During this time, you can complete the other on-boarding steps – KYC/AML checks, personalised risk warning, client categorisation, and appropriateness assessment. Investors should not be permitted to trade until the 24 hours have passed.

Firms do not need to apply the cooling off period every time, just the first time. It is important that first time clients are not given the option to opt out of the cooling off period. The FCA sees this interval as a positive friction to stop impulsive first-time traders, to ensure they take the time to think about the potential risk.

Appropriateness assessment

Firm will be required to assess whether cryptoasset investments are appropriate for their customer, prior to permitting the trade. This requires the firm to assess whether the customer has the necessary experience and knowledge to understand the risks involved in investing in cryptoassets. If a customer fails the appropriateness assessment, the firm must wait 24 hours before re-assessing whether the client is appropriate again. Firms must not encourage customers to re-take the test or tell them exactly where they fell short.

How you achieve a robust framework depends on a variety of factors and hence, the FCA is not prescriptive about how you frame the questions or the number of questions that you should ask.

The extent of information regarding a client’s knowledge and experience depends on the nature of the client, the nature and extent of the service to be provided and the type of product or transaction envisaged, including their complexity and the risks involved.

Every firm’s business model and offering are different, and every product also carries its own unique risks, features etc, which need to be considered when developing the assessment.

For investments into cryptoassets, it is not enough to ask the question ‘Do you have investment experience? ‘Yes’ or ‘No’; or ‘How knowledgeable are you in relation to investments?’ ‘High’, ‘Medium’ or ‘Low’. These are the sort of questions that we see in appropriateness questionnaires used by advisers in relation to vanilla mainstream retail products.

You should seek to ask more searching questions because the risks and complexity of crypto assets calls for such questioning. The FCA provides in its guidance, 12 topics which the appropriateness tests should cover. This does not necessarily mean that firms should ask 12 standalone questions. You could use the following 2 questions for example, to cover several of the 12 topics prescribed by the FCA:

‘Approximately what percentage of your overall portfolio is invested in qualifying cryptoassets at current value?’

a. Less than 5%

b. At least 5% but less than 10%

c. At least 10% but less than 25%

d. At least 25% but less than 50%

e. At least 50% but less than 100%

f. 100%

‘The value of your cryptoasset investments may fall below the price you paid. Performance may be highly volatile and as an FCA registered firm, our services do not protect investors against poor investment performance.’

Given the above statement, to what extent would you be worried about your future financial security?’

a. Not worried at all

b. Slightly worried

c. Very worried

It is also important to remember that proportionality applies, and that the client categorisation piece contributes to the overall assessment of appropriateness. Say for example, the client is a HNW and not a sophisticated investor, the type of questions you may wish to ask to assess appropriateness might be different for each investor type.

Treatment of existing clients

Where a customer has already traded crypto with a firm; and the firm has completed their ‘client classification’; assessed that cryptoassets are appropriate for the customer, then the firm can continue to let them trade. If one or all of those elements are missing, the firm would need to take the customer back through the missing parts of the customer journey before they can trade again.

FCA enforcement

The FCA reminds firms that a breach of the regulatory rules will amount to a criminal offence punishable by up to two years imprisonment.

How FSCOM can help

Full-scope implementation of the end-to-end customer journey:

We have supported existing clients with the end-to-end implementation programme, covering all aspects of the customer journey. This includes, for example:

- Alignment with existing product governance arrangements.

- Implementation of client categorisation framework.

- Implementation of appropriateness framework.

- Guidance on technology enabled compliance.

- Guidance on firm self-assessment (Competence and Expertise).

Bespoke policies and procedures suite:

- Development of financial promotions policy.

- Development of sign- off procedures.

- Development of on-going monitoring procedures.

- Development of Management Information framework, including compliance monitoring testing.

- Review and enhancement of breaches and escalations procedures to ensure rules are implemented regarding the reporting and resolution of financial promotions related breaches.

- Provision of templates: Financial Promotion ‘Checklists’, process ‘Decision Tree’ and a Sign Off form.

- Development of record-keeping checklists.

Staff training workshops:

We will develop and deliver training to Marketing and/or Compliance teams on what the rules mean for their work and what they should be looking out for when preparing, issuing, and approving Financial Promotions. These training sessions will also serve as workshops, offering scenario analysis, case studies and complementary quizzes for firms requiring CPD-specific training.

This post contains a general summary of advice and is not a complete or definitive statement of the law. Specific advice should be obtained where appropriate.