In the third instalment of fscom’s “Decoding Digital Assets” series, Heather O’Gorman, Head of Digital Assets, explores the evolution of UK crypto regulation, taking a look at the journey up to now, and what is on the horizon. Understanding these regulatory dynamics is crucial for businesses navigating the fast-changing crypto landscape.

The road to regulation: how the UK got here

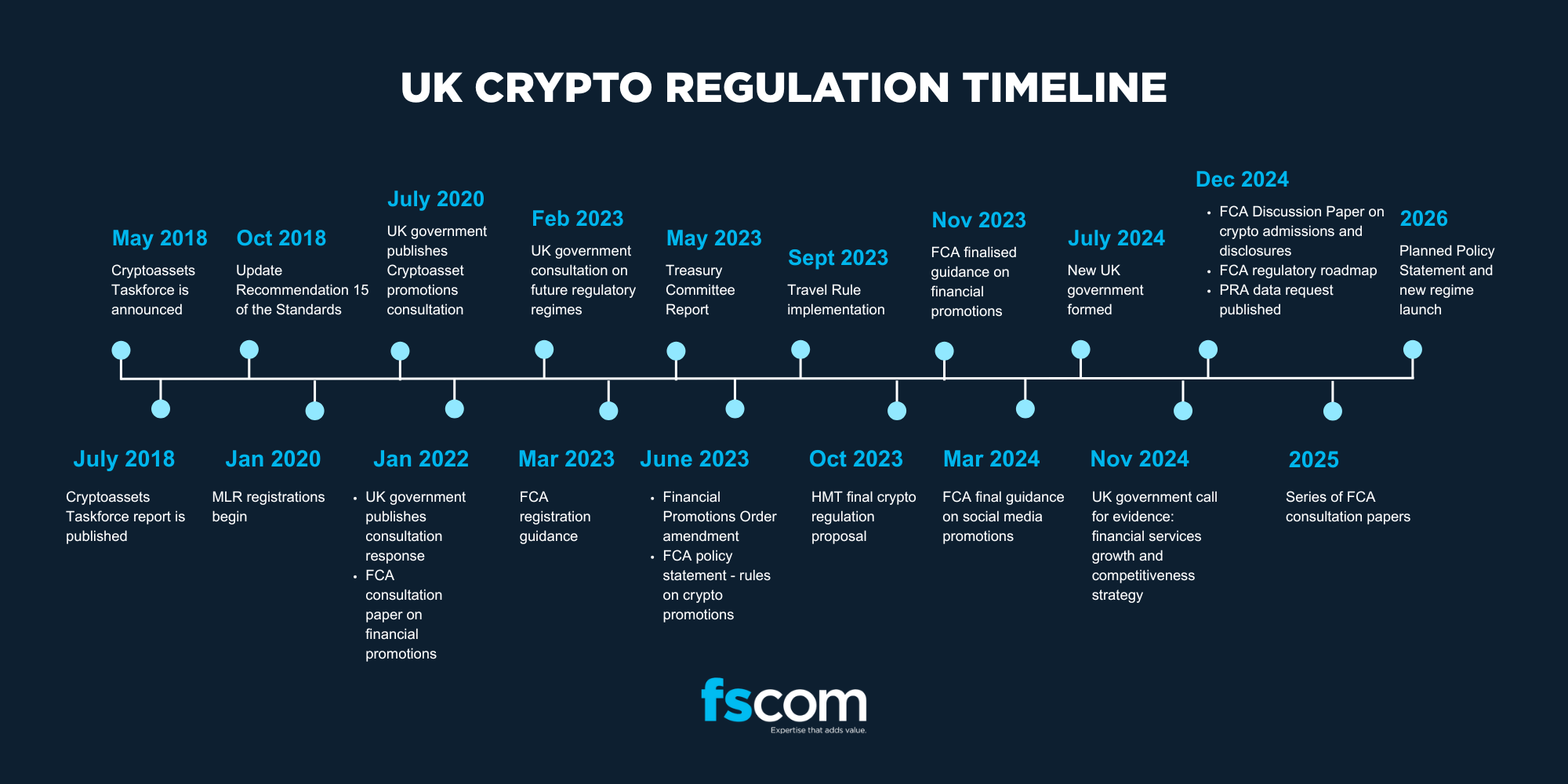

The UK’s journey toward crypto regulation began in earnest with the formation of the Cryptoassets Taskforce in 2018, bringing together the FCA, the Bank of England (BoE), and HM Treasury (HMT). This marked the first concerted effort to understand and regulate the emerging crypto sector. The 2018 Taskforce Report set out the government’s concerns about consumer protection, financial stability, and market integrity while also acknowledging the potential benefits of crypto innovation.

Concurrently, in October 2018, the Financial Action Task Force (FATF) updated its standards to clarify their application to virtual assets and virtual asset service providers by amending Recommendation 15 and adding two new definitions to the FATF Glossary. These updates required countries to assess and mitigate risks associated with virtual asset activities and service providers, license or register service providers, and subject them to supervision or monitoring by competent national authorities.

Over the next few years, these concerns laid the groundwork for the development of the Money Laundering Regulations (MLRs), which would later require crypto businesses to register with the FCA, ensuring compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) requirements. This early regulatory approach focused on mitigating risk and complying with FATF standards rather than fostering innovation, signalling the UK’s cautious stance on crypto regulation.

Where are we now? The state of UK crypto rules

Fast forward to today, and the UK’s regulatory framework for cryptoassets has evolved significantly. One of the most notable developments is the implementation of the Travel Rule, which requires crypto businesses to collect, verify, and share information on cryptoasset transfers to comply with international anti-money laundering standards. This aligns the UK with global financial crime prevention efforts.

Financial promotions (fin proms) have also become a major area of focus, with the FCA enforcing strict new rules on how crypto services are marketed to consumers. Promotions must now be fair, clear, and not misleading, and non-compliant firms risk enforcement action, including being placed on warning lists.

Another key area of regulation is staking. While staking is widely used within the crypto ecosystem, concerns around consumer risk and financial stability have led regulators to scrutinise it more closely. However, recent legislative updates clarify that staking is not considered a collective investment, alleviating concerns that it could be treated under traditional investment laws. The latest proposals indicate that staking services may be brought within the FCA’s expanded regulatory perimeter, ensuring that firms offering such services adhere to clear consumer protection standards. These developments illustrate the UK’s evolving approach.

Political shifts and the uncertain future of UK crypto laws

The UK’s crypto regulatory direction has been significantly influenced by political shifts. The recent change in government in 2024 has created an environment of uncertainty regarding the pace and scope of regulatory developments. While initial announcements primarily focused on tax implications for crypto, the City Tokenisation Summit in November 2024 marked a turning point. Economic Secretary to the Treasury, Tulip Siddiq, signalled a shift in strategy, suggesting that future regulation could take a different shape than that proposed by the previous government.

The most significant policy shift has been the government’s decision to abandon the previously planned phased approach to crypto regulation. Instead of first regulating fiat-backed stablecoins before addressing the broader crypto market, the new approach aims to legislate for all aspects of cryptoassets simultaneously.

Looking ahead, 2025 is expected to be a pivotal year for UK crypto regulation, with new FCA initiatives and consultations on trading platform rules, intermediation, lending, and staking. The government’s willingness to embrace digital assets, as seen in discussions around issuing digital gilts on the blockchain, suggests a potential shift toward a more innovation-friendly regulatory stance. The extent to which these changes will contribute to a thriving cryptocurrency ecosystem is yet to be determined. Regulators continue to balance risk mitigation with industry growth, and the protracted timeline for implementing new regulations creates uncertainty in the market, while lagging behind faster-moving jurisdictions.

You can view the full timeline, including the details and significance of each regulatory development here.

Looking ahead

As the UK moves forward with its crypto regulatory framework, the next few years will be pivotal in shaping its position in the global digital asset economy. While recent policy shifts suggest a more comprehensive approach to regulation, uncertainty remains regarding the balance between risk mitigation and fostering innovation. With new FCA initiatives and legislative proposals on the horizon, the UK’s regulatory stance will continue to evolve, shaping the future of crypto businesses and their ability to operate within the financial system. Whether this approach will position the UK as a leader in the space or leave it trailing behind more agile jurisdictions remains to be seen.

This post contains a general summary of advice and is not a complete or definitive statement of the law. Specific advice should be obtained where appropriate.