With all the excitement around re-authorisation, the ban on credit card surcharges and the new payment services activities, the less headline grabbing regulatory changes introduced by the second payment services directive (PSD2) have been somewhat overlooked. One of these changes relates to complaint handling.

PSD2 sets out new requirements for dispute resolution, including changes to response timeframes and new complaint reporting requirements.

The new rules significantly reduce how long payment service providers can take to respond to certain types of complaints (from 8 weeks to 15 business days!). These rules apply to all payment service providers – banks, authorised payment and e-money institutions, small payment and e-money institutions and registered account information service providers.

Payment service providers have always had to be able to identify and deal with complaints properly but now they must also be able to distinguish which ones are what is known as ‘PSD complaints’ and ‘EMD complaints’.

So, what is a PSD complaint?

A PSD complaint is a complaint that relates to the conduct of business rules in the Payment Services Regulations 2017 (the PSRs). The conduct of business rules fall into two main categories:

- information that must be provided to customers before and after the execution of a payment transaction (for example, as part of terms and conditions) (Part 6 of the PSRs); and

- the rights and obligations of both the payment service provider and the customer in relation to payment transactions (e.g. charges, consent, liability etc.) (Part 7 of the PSRs).

And an EMD complaint?

An EMD complaint is a complaint that relates to the conduct of business rules in the Electronic Money Regulations 2011 (EMRs).

- Part 5 of the EMRs sets out the rights and obligations in relation to the issuance and redemption of e-money.

So, for example, if a customer’s complaint relates to a clause within the terms and conditions, it’s likely to be a PSD complaint. However, if a customer phones to complain about a rude employee, this is unlikely to be a PSD complaint, though you might still want to have a word with the employee!

Can anyone make a complaint?

Yes, but how payment service providers deal with complaints should differ depending on whether it is a PSD/EMD complaint and whether the complainant is an eligible complainant.

An eligible complainant is anyone who is eligible to bring a complaint to the Financial Ombudsman Service.

Access to the Financial Ombudsman Service is available to consumers, micro-enterprises, small charities and small trusts. However, this may be subject to change as the FCA released a consultation in January 2018 proposing to extend the scope of eligible complainants to include larger SMEs, charities and trusts. This could result in a new category of eligible complainant, ‘small businesses’. If agreed, the changes will come into effect on 1 December 2018.

So, what is the impact on payment service providers?

Complaint handling timeframes

When dealing with a PSD/EMD complaint, payment service providers must provide a full written response within 15 business days, or 35 business days in exceptional circumstances. This is significantly shorter than the old response period of eight weeks. Payment service providers must inform a customer within 15 business days if their complaint is considered to involve exceptional circumstances and indicate the reasons for the delayed response.

To reflect PSD2’s shorter response time frame, customers have the right to refer their complaint to the Financial Ombudsman Service 35 business days after the payment service provider has received their complaint, or after 15 business days where they have not received a holding response.

FCA Reporting

Payment service providers now have to complete the new Payment Services Complaint Return on an annual basis. While the new complaint rules came into effect on 13 January, the FCA has allowed a transition period for complaint reporting. Therefore, the first reporting period begins on 13 July 2018 for all payment service providers.

From this date, payment service providers must ensure they are able to identify and triage PSD2 complaints, including separating out elements of multifaceted complaints into PSD/EMD and non-PSD/EMD.

Where can I find the new complaint handling rules?

The rules for handling complaints from eligible complainants are set out in DISP (the Dispute Resolution: Complaints sourcebook in the FCA handbook). The rules within DISP differ depending on whether the complaint is a PSD/EMD complaint or not.

The rules for handling PSD/EMD complaints from non-eligible complainants are set out in regulation 101 of the PSRs.

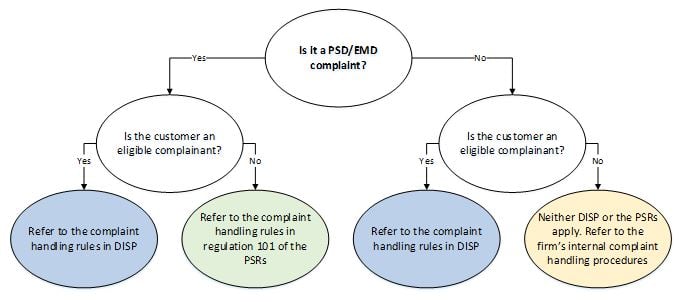

The below decision tree should help payment service providers determine which complaint handling rules apply in which circumstances.

You can see from the decision tree that where a complaint is a non-PSD complaint from a non-eligible complainant, neither DISP nor the PSRs apply. Therefore, payment service providers have no regulatory obligations for dealing with the complaint. However, as a payment service provider, it is obviously not in your interest to have unhappy customers so you will want to deal with complaints quickly and effectively to ensure great customer service. Additionally, it may just be more straightforward to deal with all complaints in line with the stricter PSD2 complaint handling rules rather than having two sets of procedures which may cause confusion for staff and customers.

What should payment service providers be doing now?

If they haven’t done so already, payment service providers should be concentrating efforts on training and awareness to ensure that staff can distinguish a PSD/EMD complaint and are aware of the new timescales.

Payment service providers should already have updated their internal complaints handling policies and procedures and the complaints handling literature they provide to customers to reflect the new requirements.

Payment service providers must ensure systems, processes and practices are appropriate to identify and deal with PSD/EMD complaints. By now they should have tested the new processes, controls and governance implemented to ensure new complaints handling requirements are met and will withstand regulatory scrutiny.

And finally, payment service providers should assess whether upgrades or enhancements need to be made to reporting systems and processes in order to provide accurate complaints data to the FCA.

If you would like help understanding the new complaint handling rules or require assistance updating your systems, processes and practices to reflect the new complaints handling requirements, please get in touch.

This post contains a general summary of advice and is not a complete or definitive statement of the law. Specific advice should be obtained where appropriate.